Navigating the Landscape of Meredith, NH: Understanding the Tax Map

Related Articles: Navigating the Landscape of Meredith, NH: Understanding the Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape of Meredith, NH: Understanding the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Meredith, NH: Understanding the Tax Map

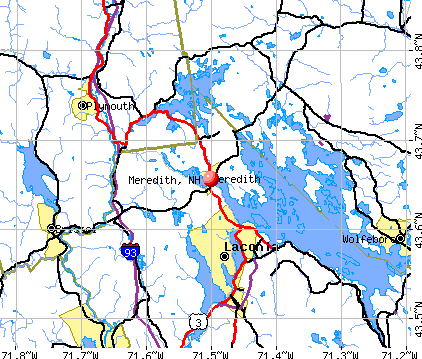

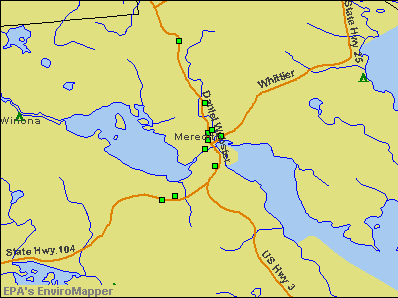

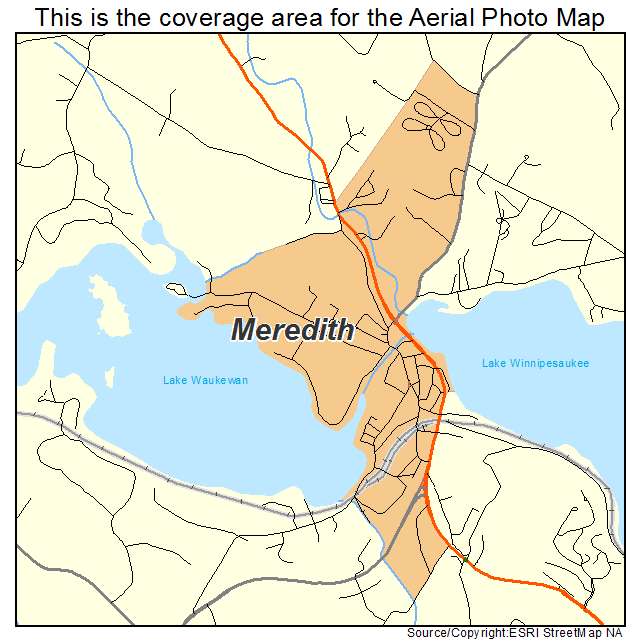

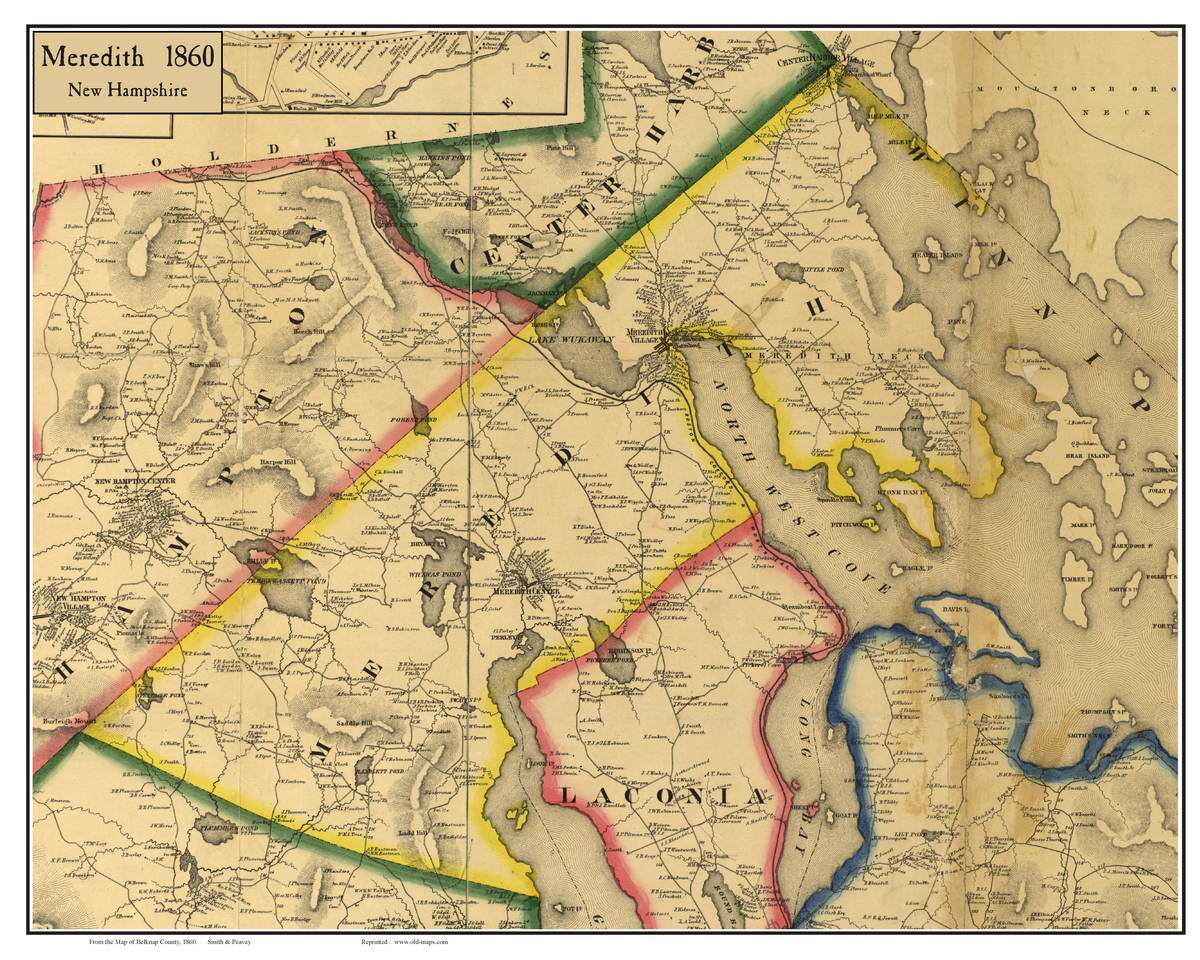

The Meredith, NH Tax Map serves as a vital tool for understanding the intricate tapestry of property ownership and valuation within the town. This comprehensive map, meticulously maintained and updated by the Meredith Assessor’s Office, provides a visual representation of each parcel of land within the town’s boundaries. Each parcel is assigned a unique identification number, allowing for efficient tracking and management of property data.

A Detailed Look at the Meredith, NH Tax Map

The Meredith, NH Tax Map is far more than a simple visual representation. It is a repository of detailed information about each property, encompassing:

- Parcel Identification Number (PIN): This unique identifier serves as the primary key for accessing information about a specific property.

- Property Address: The map clearly indicates the street address associated with each parcel, facilitating easy location identification.

- Property Boundaries: The map outlines the precise boundaries of each parcel, defining the extent of ownership.

- Land Use: The map specifies the designated land use for each parcel, whether residential, commercial, industrial, or agricultural.

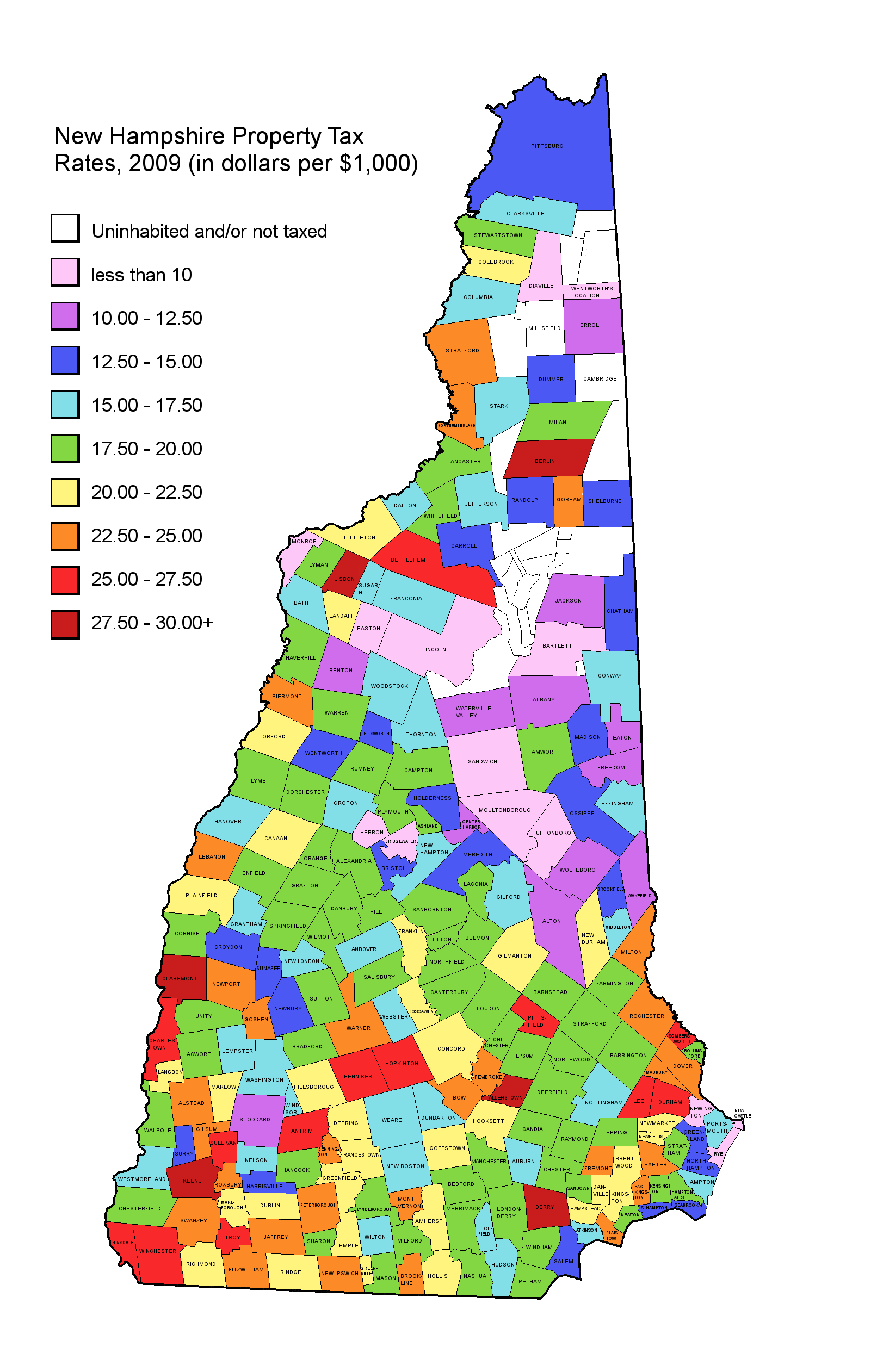

- Property Value: The map reflects the assessed value of each property, a crucial factor in determining property taxes.

- Zoning: The map indicates the zoning classification of each property, dictating permissible land uses and development activities.

Accessing the Meredith, NH Tax Map

The Meredith, NH Tax Map is readily accessible to the public, ensuring transparency and promoting informed decision-making.

- Online Access: The Meredith Assessor’s Office provides online access to the tax map through its website, enabling users to easily explore the map and retrieve property information.

- In-Person Access: Residents and interested parties can access the tax map in person at the Meredith Assessor’s Office during regular business hours.

The Importance of the Meredith, NH Tax Map

The Meredith, NH Tax Map plays a pivotal role in several key aspects of town governance and resident life:

- Property Tax Assessment: The map serves as the foundation for accurate and equitable property tax assessments, ensuring that each property owner contributes their fair share to the town’s budget.

- Land Use Planning: The map provides valuable insights into land use patterns, assisting town officials in developing comprehensive land use plans that balance growth with environmental protection.

- Property Transactions: The map facilitates smooth property transactions by providing clear and detailed information about property boundaries, zoning regulations, and assessed value.

- Emergency Response: The map aids emergency responders in quickly identifying property locations and assessing potential hazards, enhancing response efficiency and public safety.

- Community Development: The map serves as a valuable resource for developers, architects, and other stakeholders involved in planning and executing community development projects.

FAQs about the Meredith, NH Tax Map

1. How do I find my property on the tax map?

You can find your property on the tax map by using the online search function on the Meredith Assessor’s Office website. Simply enter your property address or PIN, and the map will highlight your parcel.

2. How do I access the tax map in person?

You can access the tax map in person at the Meredith Assessor’s Office during regular business hours.

3. What information is included on the tax map?

The tax map includes information about each property, including the parcel identification number, property address, boundaries, land use, assessed value, and zoning classification.

4. How often is the tax map updated?

The tax map is updated regularly to reflect changes in property ownership, land use, and assessed values.

5. How can I request a correction to the tax map?

If you believe there is an error on the tax map, you can contact the Meredith Assessor’s Office to request a correction.

Tips for Using the Meredith, NH Tax Map

- Familiarize yourself with the map’s key features: Take some time to understand the map’s layout, symbols, and legend before beginning your search.

- Use the search function effectively: The online search function is the most efficient way to locate a specific property.

- Review property information carefully: Ensure that the information displayed on the map matches your understanding of the property.

- Contact the Assessor’s Office for assistance: If you have any questions or need further clarification, do not hesitate to contact the Meredith Assessor’s Office.

Conclusion

The Meredith, NH Tax Map is an indispensable tool for understanding the town’s property landscape. Its comprehensive nature, accessibility, and ongoing maintenance ensure that residents, businesses, and government agencies have access to accurate and up-to-date property information. By utilizing this valuable resource, individuals can navigate the complexities of property ownership, contribute to informed decision-making, and contribute to the overall well-being of the Meredith community.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Meredith, NH: Understanding the Tax Map. We thank you for taking the time to read this article. See you in our next article!