Navigating the Rural Landscape: Understanding USDA Loan Eligibility in Missouri

Related Articles: Navigating the Rural Landscape: Understanding USDA Loan Eligibility in Missouri

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Rural Landscape: Understanding USDA Loan Eligibility in Missouri. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Rural Landscape: Understanding USDA Loan Eligibility in Missouri

- 2 Introduction

- 3 Navigating the Rural Landscape: Understanding USDA Loan Eligibility in Missouri

- 3.1 Unveiling the USDA Loan Map: Defining Rural Missouri

- 3.2 Delving Deeper: Unveiling the Eligibility Criteria

- 3.3 The Benefits of USDA Loans in Missouri

- 3.4 Navigating the Application Process: A Step-by-Step Guide

- 3.5 Frequently Asked Questions (FAQs)

- 3.6 Tips for Successful USDA Loan Applications

- 3.7 Conclusion

- 4 Closure

Navigating the Rural Landscape: Understanding USDA Loan Eligibility in Missouri

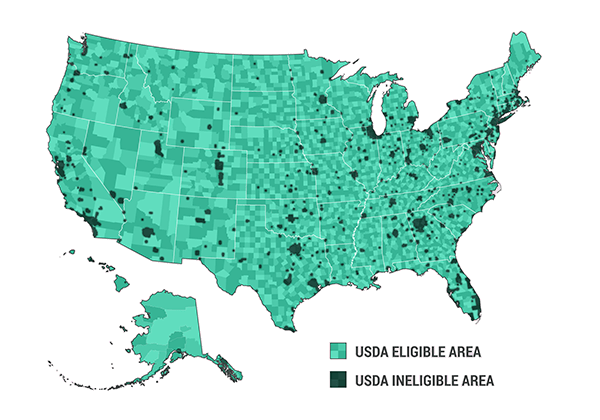

The United States Department of Agriculture (USDA) offers a range of loan programs designed to assist eligible individuals in purchasing, building, or rehabilitating homes in rural areas. These programs, collectively known as USDA Rural Development loans, play a crucial role in fostering economic growth and community development in rural communities across the nation, including Missouri.

Unveiling the USDA Loan Map: Defining Rural Missouri

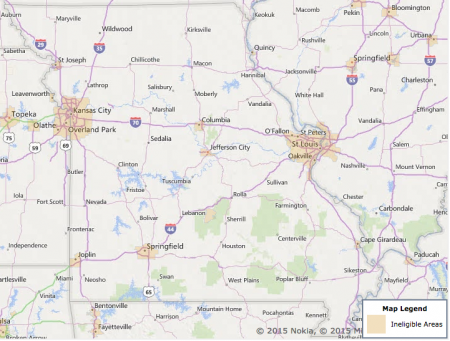

Understanding the geographical scope of USDA loan eligibility is paramount. The USDA defines "rural" based on population density and other factors. Missouri, with its diverse landscape encompassing rolling hills, fertile farmlands, and bustling urban centers, presents a complex picture when it comes to USDA loan eligibility.

The USDA Rural Development website provides an interactive map tool that allows users to explore specific areas in Missouri and determine their eligibility for USDA loan programs. This tool is a valuable resource for potential borrowers, offering a visual representation of eligible regions and helping them understand the program’s reach within the state.

Delving Deeper: Unveiling the Eligibility Criteria

While the USDA map provides a general overview of eligible areas, several factors beyond geographical location influence loan eligibility. These include:

- Income Limits: The USDA sets income limits for loan applicants, ensuring that the program benefits those who genuinely need financial assistance. These limits vary based on household size and location.

- Property Location: The property must be located in an eligible rural area as defined by the USDA. This often includes areas with populations under 20,000 or located in a non-metropolitan county.

- Creditworthiness: Applicants must demonstrate a good credit history to qualify for USDA loans.

- Home Type: The USDA program supports the purchase, construction, or rehabilitation of single-family homes, townhouses, and condominiums.

The Benefits of USDA Loans in Missouri

For eligible individuals, USDA loans offer several advantages:

- Lower Interest Rates: USDA loans often have lower interest rates compared to conventional mortgages, making homeownership more affordable.

- No Down Payment: In many cases, USDA loans require no down payment, reducing the initial financial burden for borrowers.

- Flexible Loan Terms: USDA loans offer flexible terms and repayment options, providing greater financial flexibility to borrowers.

- Community Development: USDA loans contribute to the economic vitality of rural communities by supporting housing development and creating opportunities for residents.

Navigating the Application Process: A Step-by-Step Guide

Applying for a USDA loan involves several steps:

- Pre-Qualification: Contact a USDA-approved lender to determine your eligibility and obtain a pre-qualification.

- Credit Check: Provide the lender with your credit information for a thorough credit check.

- Home Search: Begin your home search in eligible rural areas using the USDA map tool.

- Loan Application: Once you find a suitable property, submit a formal loan application to the lender.

- Loan Approval: The lender will review your application and, if approved, issue a loan commitment.

- Closing: After finalizing the loan terms and completing necessary paperwork, you will close on the property.

Frequently Asked Questions (FAQs)

Q: What are the income limits for USDA loans in Missouri?

A: Income limits vary based on household size and location. You can find specific income limits for your area on the USDA Rural Development website.

Q: Can I use a USDA loan to purchase a second home?

A: No, USDA loans are specifically designed for primary residences.

Q: What are the closing costs associated with a USDA loan?

A: Closing costs vary depending on factors such as property location and loan amount. You can discuss closing costs with your lender during the application process.

Q: Can I use a USDA loan to purchase a farm?

A: While USDA loans are not specifically designed for farm purchases, they may be available in certain circumstances. Contact a USDA-approved lender for more information.

Q: What happens if I default on my USDA loan?

A: Defaulting on a USDA loan can have serious consequences, including foreclosure and damage to your credit score. It is important to make timely payments and communicate with your lender if you encounter any financial difficulties.

Tips for Successful USDA Loan Applications

- Check your credit score: Ensure your credit score is strong before applying for a USDA loan.

- Gather all necessary documentation: Have your income verification, tax returns, and other required documents readily available.

- Work with a USDA-approved lender: Choose a lender experienced in USDA loan programs to guide you through the process.

- Understand the terms and conditions: Carefully review the loan terms and conditions before signing any documents.

- Be prepared for potential delays: The USDA loan process can take time, so be patient and prepared for potential delays.

Conclusion

USDA loans play a vital role in promoting homeownership and economic growth in rural areas of Missouri. By understanding the eligibility criteria, benefits, and application process, potential borrowers can navigate this program effectively and achieve their homeownership goals.

The USDA Rural Development website and its interactive map tool serve as valuable resources for understanding eligibility and exploring available properties. By utilizing these resources and working with a knowledgeable lender, individuals seeking homeownership opportunities in rural Missouri can unlock the potential of USDA loans and build a bright future in their chosen communities.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Rural Landscape: Understanding USDA Loan Eligibility in Missouri. We thank you for taking the time to read this article. See you in our next article!